Photo by Jp Valery on Unsplash

Preface

Earlier this spring, I started noticing these What I Spend in a Week videos trending, and I was inspired (as well as shocked) by a few of them, but started following a few accounts on Twitter and started to use the platform as my news source rather than local news (probably a poor decision), however #pftwitter is actually relatively light-hearted compared to the other things that are going on during this pandemic + election year.

After a few interactions, I was asked to start posting about personal finance things by Courtney, over at youraveragedough, even though I had initial wanted to do something similar back when I created this site in early 2019, just never got around to it. This thread, in particular, we were talking about credit card churning, which was not a mistake for me (that’s right, Dave Ramsey), and ended up saving me a bunch of money on travel, so topic for another post.

By comparison, I’m not a CPA or strictly-finance blogger, so here’s to making this more personal than finance related! 🥂

These “mistakes” are to highlight that I have thought about savings, investing, and my educational/career choices from a very young age with very little external influences other than close family to get me started.

Here’s how we’re going to break this down

Intro

For $100, could you, around ages 3-5, have named the man on that bill?

This was the challenge I vividly remember being given one evening by my uncle, while visiting my grandmother’s house with my Dad. The only hint I had been allowed was that the person had not served as a U.S. President.

With my mind churning, and heart thumping, I recall wanting the bill so badly, but yet I’d given up. I could not come up with the answer. I had grown up in the Land of Lincoln, so it’s possible that he was the one and only President I could list off at that age.

I’m not sure if that experience is what got me interested in money, but I also recall, on occasion, hearing reasons I could not have some seemingly expensive item. It definitely didn’t help that I’d grew up in my early childhood within walking distance to a Toys R Us, or that I’d be left in the video game section at Target while my mom had gone shopping. At some point, I became aware that if I wanted something that my parents thought was expensive, I needed to make note of the price for it, then patiently save up until I could afford it myself. Being young, I didn’t realize taxes were a thing, so of course I only saved up as much as the sticker price; however, if the price had went on sale over the course of me saving up for it, then I could more easily afford it. Such items were mostly games or the next generation gaming console at the time.

I’d say I’d been “good” with money decisions while living at home, but once I started earning money and paying for myself, I’ve made plenty of “mistakes” along the way. I remember finding Mint.com very early in its development when I’d only had a checking and savings account at one bank, so really didn’t need to use any account tracking software other than I liked the charts it generated. Additionally started using PersonalCapital in late 2016, I think, but I have been toying with the idea of using something other than those, since obvious privacy concerns giving away bank login information to third parties.

So, here we are, one decade later. Let’s see how good my memory is regarding the worst money decisions I’ve made so far!

Younger years

Mistakes

- Too much money on video games

- Not saving my Sacagawea dollar coins

I had a regular, quarterly cash income from being paid for doing well in school. It was a tiered system such as the following

| Grade | Amount (USD) |

|---|---|

| C | 1 |

| B | 5 |

| A | 10 |

| A+ | 20 |

Then, if I’d received straight-A’s, I believe I had eventually negotiated my way up to a bonus of $100; meaning straight A+’s would have net me $200 for 5 courses (Math, Science, English, Social Studies/History, and some elective). And there were multiple semesters in the school year, so I could easily make over $500/yr just by doing well in school. Unfortunately, I wasn’t very good at English & Social Studies, so that was my first mistake. (Joking 😅). A serious unfortunately, was that I was a bit of a shut-in and tended not to identify with many of my classmates. All things considered, that ultimately enabled me to not spend as much, though.

Majority of gift money I had saved. I have never been very good at thinking of gift ideas for myself or others, and eventually I started getting gift cards to Best Buy or just cash from friends and relatives for birthdays and holidays. Eventually, I ended up holding onto Amazon Gift Cards, then using that money to buy gifts for the person that got me the card rather than pay out of pocket for something.

Summer evenings were mostly spent on family game nights, dining, watching movies and shows; family was never big into sports, which I feel like is where a lot of advertising and consumerism is generated. Most of my summer days were spent at summer camp, including as an unpaid counselor for a few years, which was a very frugal way to enjoy being outdoors and get really tan with sunbleached hair!

Thanks, genes. I enjoyed not having bald spots.

Overall, for the money that I did spend on games, the games that I played were adventure/puzzle games, which had long play times that I didn’t get bored with easily, as compared to FPS or Sports games (although, I did win millions of virtual moneys on Tiger Woods Golf by winning all the tournaments). I did make the unfortunate decision to spend all my Sacagawea coins on a video game guidebook, at Circuit City of all places, which is now bankrupt.

Even though I’d gotten access to my own laptop late into high school, I was more into console games, and mobile games weren’t yet a big deal. I think if I’d have had access to those sooner, and seen the “micro-transaction” economy, then I might have regularly spent even more money on that.

High School

Mistakes

- Lack of saving for College expenses when I was interested in pursuing STEM

- Failing to consistently put at least 10-15% of income into an IRA

- Losing money to inflation in little-to-no interest bearing accounts

- Applied to an out-of-state, private, engineering university, having the highest tuition of all that I’d applied and visited

By the time I had opened a Checking/Savings account during High School (during the recession, mind you), I remember having about $5k in my accounts, but I don’t really recall where the majority of that came from. I also remember feeling weird about having a debit card at that age, when I typically associated swiping cards as more of an “adult” thing to do. That being said, I very rarely purchased anything and money never came out of that 0.01% APY Savings account until many years later.

Knowing about high-interest savings accounts now, that was another mistake I had made, even though the difference would only have been a few hundred dollars, assuming a moderate 1% APY. After reading I Will Teach You To Be Rich, I later found out there were reward based checking accounts!

2009

For my first summer job, I ended up working at a Garden Center for minimum wage. It looked similar to this image after they installed the sun-coverings, but otherwise, I remember it being a very hot, sunny summer and I did not spend much time near the shaded plants. It was tolerable, though, since I was also the one tasked with walking around to water the plants, so I could just mist myself once in a while.

Photo by Christin Noelle on Unsplash

While working, I would frequently get asked some random questions like where were certain plants (petunias, cardamom, chrysanthemums? ¯\_(ツ)_/¯) or types (annuals, perennials? ¯\_(ツ)_/¯) located… yes, I recall these from memory, did not look them up… I frequently requested my co-workers create a map of the property so that I wouldn’t have to dial them on the walky-talky or dismiss the customers (even back then I wanted to help people!).

All I really knew about the plants is that some smelled nice, others not so much, some needed lots of water, and others needed relocated in the heat of the mid-afternoon.

As far as money mistakes go, well, as I was earning a taxable income, sticking a few thousand in a Roth IRA account at the age of 16 would have been awesome (since that would have turn into somewhere between $30-45k at age 55 at 7% APY). Otherwise, I could have been explicitly saving for college, although I don’t think I gave it much thought at the time.

My first car was a 1996 Honda Accord with only one previous owner. I think we got it for a few thousand, which meant no car payments. I drove to work myself and typically brought my own lunch rather than eat out, so the only expenses I really had, while living at home, were gas, video games, and the occasional night-out. I did “save” the money, but it was mostly parked in a checking account, not earning interest.

2010

The next summer I worked an office job upgrading machines from Windows XP (remember those days?) to Windows 7. I was competing in interviews with the local community college students for the role, and ended up getting an offer for $10/hr. I ended up car-pooling with co-workers, and still rarely went out for lunch, saving me money on gas and food.

Photo on Free-Images.com.

I did work in a cubicle (not this one), socially distanced from others, and had to wear collared shirts and slacks all summer. There was no nearby window, but I managed to stay busy enough to take my mind off my confined area. I quickly came to the conclusion that I didn’t want my future career to be stuck in a cubicle. Thankfully, major tech companys’ offices aren’t like that at all (well, I’m not employed by a name-brand, big tech company, and we’re all currently working from home, so there’s that).

After the summer was over, I did open a traditional & Roth IRA account at the suggestion of my mom, and still have that account open today. I probably could have contributed more to it, but I was also paying for ACT prep courses, ACT+SAT exams, and community college classes & books during the summer.

I still have yet to understand the argument for Traditional contributions over a Roth, but there might be some reasonable math there that plays out better one way or the other.

It was at this job that I had discovered my undergraduate university of choice through the recommendation of my boss.

Undergrad Life

Mistakes

- Doing as little as possible to reduce my future student debt

- Student housing over off-campus

- Studying over working for income

- Using on-campus meal plans even though we had a full kitchen in the dorms

- Giving away money/time in exchange for unreturned affection or attention 💔

- Overall, still not understanding how people made money and how it could be used for investing outside of furthering one’s education

- Lack of interest in materials outside my studies

- Picking Psychology and Philosophy over Econ

2011-2015

Going in, I knew I wanted to do Software Development; in fact, I think a large percentage of students stuck with their initial majors. Freshman Year was not completely “Common Core” material, and I think if anyone had switched from a 2 year college to there, they would have been at a serious disadvantage.

I started undergrad a few months early for a summer program known as Fast Track Calculus. It was the most intense, anxiety-inducing, sleep-deprived five weeks of my life, and I got a crummy T-shirt to prove it!

To make up for the stressful-ness of the new environment, I did have a fantastic view of campus! (Top floor, on the end).

Photo from Rose-Hulman Website.

After tracking my spending at my jobs during high school, and not extravagantly spending in my late teens, by the time I entered college, I’d already collected a few thousand in savings that I’d lived off of throughout college to buy books, gas, food, and go to various events. Terre Haute, IN is not a major college town, however, and realistically I could have found things to do in Indianapolis had I really wanted to, but I was content with being a “cash-strapped”, stressed college kid.

I did have a really nice loft that was built (at no cost) for me. Much better than the standard bunkbeds that we all had, and it showed individuality! Some rooms had whole decks across the room that effectively moved everything off the floor a few feet, and people would sleep underneath. Was fun walking around the halls the first few weeks to tour others’ setups. Tried to sell mine after I graduated, but no takers.

2012

Rose-Hulman has career fairs every quarter (or maybe every other), and even Freshman are encouraged to go, in hopes of getting an internship. At the time, even though I had one previous tech job, it wasn’t “Software Engineering,” my major, so I was unable to present any good interview skills. I didn’t get any offers until I started applying on external sites like Monster.com or Indeed.

Eventually, about a week before finals, I was offered an internship on the north side of Indianapolis at ITT Tech’s headquarters doing development for their marketing team at $13/hr. I ended up living with my freshman roommate at his parent’s house (offered up $100/month on housing), and I never really went out at night. 1) I was only 19, 2) I didn’t feel comfortable venturing out by myself, 3) my “roommate” was working night-shifts at Walmart and day-shifts at Subway and spent rest of the time with his girlfriend, now wife.

He’s cool, though… Make sure to subscribe to SethRujiJumps and obliterate the YouTube algorithm using the like button if you want to see more Parkour!

Study Abroad

Mistakes

- Wasting my Eurail pass

- Eating out (to be fair, I did not learn to read food labels, which made shopping very hard)

- Living like a tourist rather than investing

- Consuming too much gelato

2013

I’d heard about this opportunity to study abroad in Germany from March-July very last minute. I had even applied to be a Sophomore Advisor at the same time, and got my acceptance letters for both programs during the same week. It was definitely a coin-flip for me, which luckily only ended up being for a scholarship to Study Abroad, and I had a blast.

Me, getting photobombed in Salzburg.

This trip was largely financed through me selling my car that I would no longer be needing that summer. Plus, tuition here in the U.S. was waived for the time I was away, so it was relatively much cheaper to study abroad, and my credits fully transferred through the university’s partner-program.

I think people assume that studying abroad must be an expensive experience to actually go do, but after the round-trip plane tickets (more like two one-way tix, since I was there for months), I don’t think I spent much more than €3k total (Mint only works in the U.S., I think). In comparison, U.S. tuition for that time was going to be over $20k.

I did travel around throughout Germany, as well as to Italy, Denmark, and Austria, so those trips were definitely more expensive than just roaming around my home-city. My my prior birthday, I had received a Eurail pass, which is only good for a certain timeframe from use, and I think I’d only gotten to pick 5 countries to travel to on the high-speed rail within that time-period, but only used the pass maybe once or twice… IDK, seemed like I wasted it.

But, hey, it was worth getting to try Magic Energy Popcorn from a can!

I do remember watching the stock market during this time, but not really trying to time study it for any reason. I think I just happened to use StumbleUpon and got an article how good the markets were doing. Or maybe I was trying to understand the conversion rates on EUR/USD, then finding stock data in the site I was using.

In any case, looking back now, only 7 years ago, the S&P500 has doubled in value, even after the downturn in March ‘20. Probably a mistake to hold a large amount of Euro on me, even though I had no plans on spending it. Thankfully, I did actually have a German bank account with a debit card, so I wasn’t holding onto the cash I’d brought with me on the plane, plus no foreign transaction fees trying to constantly exchange money.

Surprisingly, I lost weight in Germany… Either to all the walking, or to the lack of easy access to a school cafeteria (i.e. Freshman 15). However, I couldn’t turn down walking aimlessly down the streets without gelato in my hand(s).

Up to Graduation

Mistakes

- Getting a car payment

- Could have paid more to student loans

- More eating out

- Betting small on crypto

Returned back to Rose in fall 2013 for Junior year, with a 2004 Honda Accord, which we paid $9k for, now giving me a car payment.

Academically, Junior year was definitely the hardest year for me, even though people had said that it would be Sophomore Year. Thankfully, I was able to reach out to professors and the on-campus Health Service counselors for help adjusting to the course load that I had strapped myself with, and leaned very heavily on friends to pull me through that year.

2014

After teaching myself Android Development throughout the year for my projects, I landed an internship at Progressive Headquarters in Cleveland, OH, making $18/hr.

I didn’t meet Flo, but I did save a bunch of money … (oh wait, that’s a slogan for a different company)

They had a cafeteria on-site, and I recall mentally feeling guilty if I had food in the apartment that I could have used for lunches. Comparatively, I don’t remember going grocery shopping more than once a month, nor do I remember ordering delivery or going out on my own to eat. I will say, though, The Melt was my favorite place to eat, when we did go out as a group.

I ended up going on two trips that summer - one to Niagara Falls + Toronto, then another to Put in Bay, OH. For the latter, I was reminded by a friend recently that he’d never heard of Venmo before that trip, and everyone was trying to figure out how to pool money together, which at that point it’d been around for 5 years already. Little did he know, I was a bit of a money-savings snob, and any app I could find to earn/track/save money was likely installed on my phone.

Speaking of digital money, I did buy Bitcoin during this year, and had been watching Litecoin as well. I discovered it through a friend, who had been purchasing real, questionably legal software/hardware products with it, and I found the idea of it interesting as a transfer of value more than any such investment, so I took a few hundred from my savings account and purchased some… And now that amount is currently at 14 times higher than when I bought. Definitely not a mistake, but certainly a risk that I was willing to take. As with any “investment,” don’t put more in than you’re willing to lose.

Also went to the Rock-n-Roll Museum multiple times (friends + parents), and little did I know, that was going to subconsiouly plant the idea of Austin, TX, “live music capital of the world” in my mind.

Word-cloud of my festival-going bucket list.

Career

Mistakes

- Not considering office location relative to apartment locations

- Failing to max 401(K) the first year

- Riding out the 2017 Bitcoin craze

- Regularly blowing my food budget

I did end up getting a full-time offer from Progressive, but they wanted a decision before the school career fair, meaning that I had no leverage for salary negotiation. As far as salaries go, that information is public record, but I would like to point out that those “averages” are deceiving, given that the highest offers reported there are so high. While I do know people that I think are probably worth being paid those salaries straight out of college, I would personally like to see median salaries be reported, especially given that the Software Engineer/Computer Science majors largely go to companies in San Fran or Seattle, for example. In any case, I don’t have my graduation year’s data, but I remember trying to negotiate higher towards the average for the year, but was turned down.

I made due with what I was offered by using a budget breakdown spreadsheet I was giving during school. I couldn’t contribute to a 401(K) for 6 months from my start date, but I’d planned on starting that at 10% of income, based on some articles I’d read. In the meantime, I’d put that money towards loan payments. In my plan, I didn’t calculate how much I wanted to pay in rent until the very end, especially since I didn’t do any research on Austin rent prices yet. I ended up choosing an apartment that was a 35-60 minute drive, depending on traffic, from the office, so definitely a mistake there.

With the exception of “spending” $15+K towards loan payments and crypto in 2016, I have been able to live on about $40K a year (after tax) with at least one annual trip per year outside of holiday travel (thanks, credit card points). According to the 4% rule, that would put my FIRE number right at $1M.

Monthly Budget Breakdown

This was my budget after paying off all my debts and before buying a house. Note: This doesn’t reflect actual spending, as most values are rounded up.

| Category | Amount (USD) |

|---|---|

| Rent + Utilities | 1200 |

| Movies/Dining out | 150 |

| Groceries | 150 |

| Gas | 120 |

| Internet | 80 |

| Car Insurance | 80 |

| Sports/Recreational | 50 |

| Electricity | 35 |

| Phone | 30 |

Monthly Budget Total: $1,895

Unfortunately, I only stayed under that amount about twice in the last 5 years.

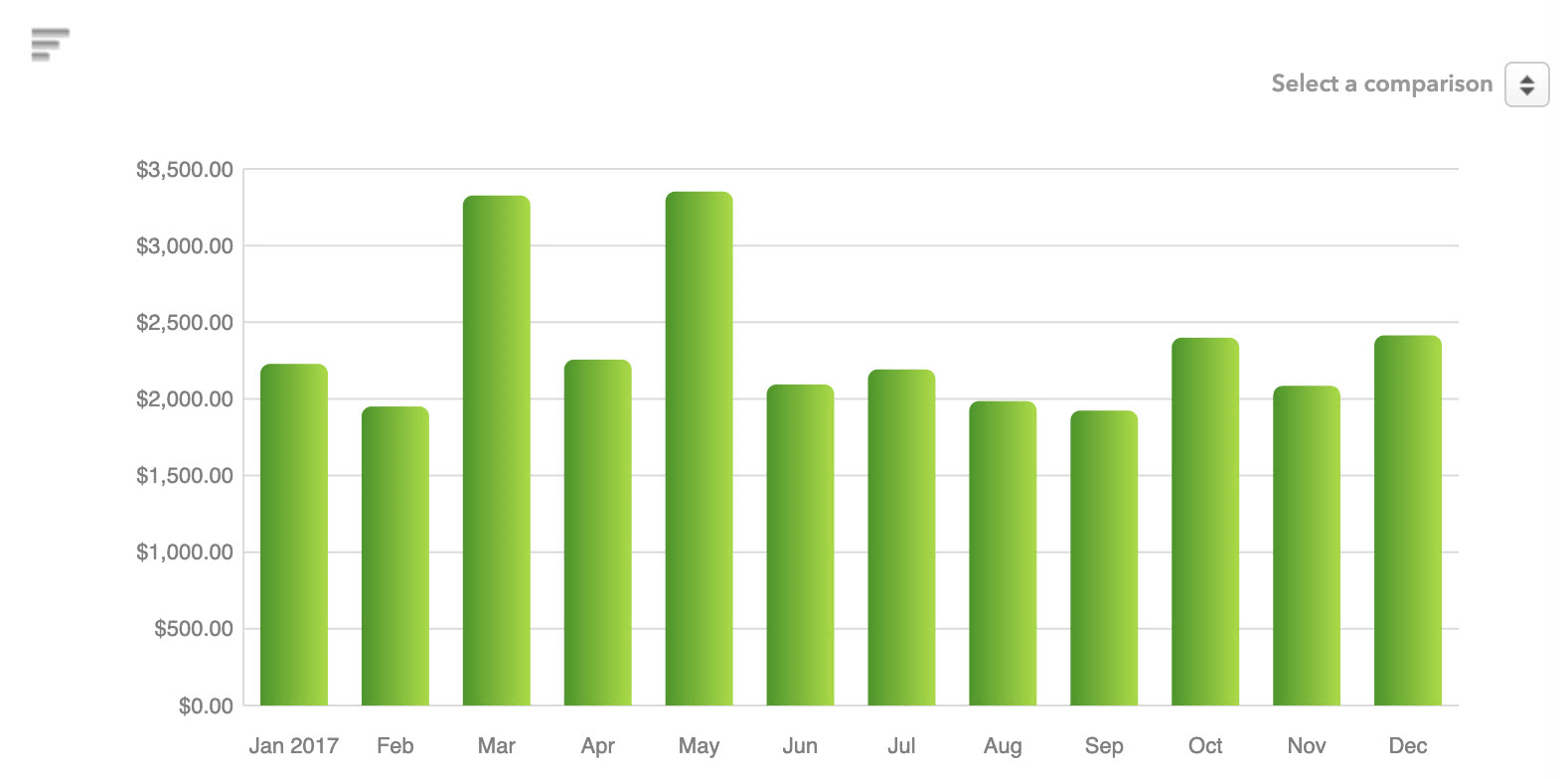

February, March, and September have historical been my lowest spending months, and 2017 has been my lowest spending year so far, with multiple months spending only around $2,000, and the higher months including paying for a trip to Italy.

Here’s 2017.

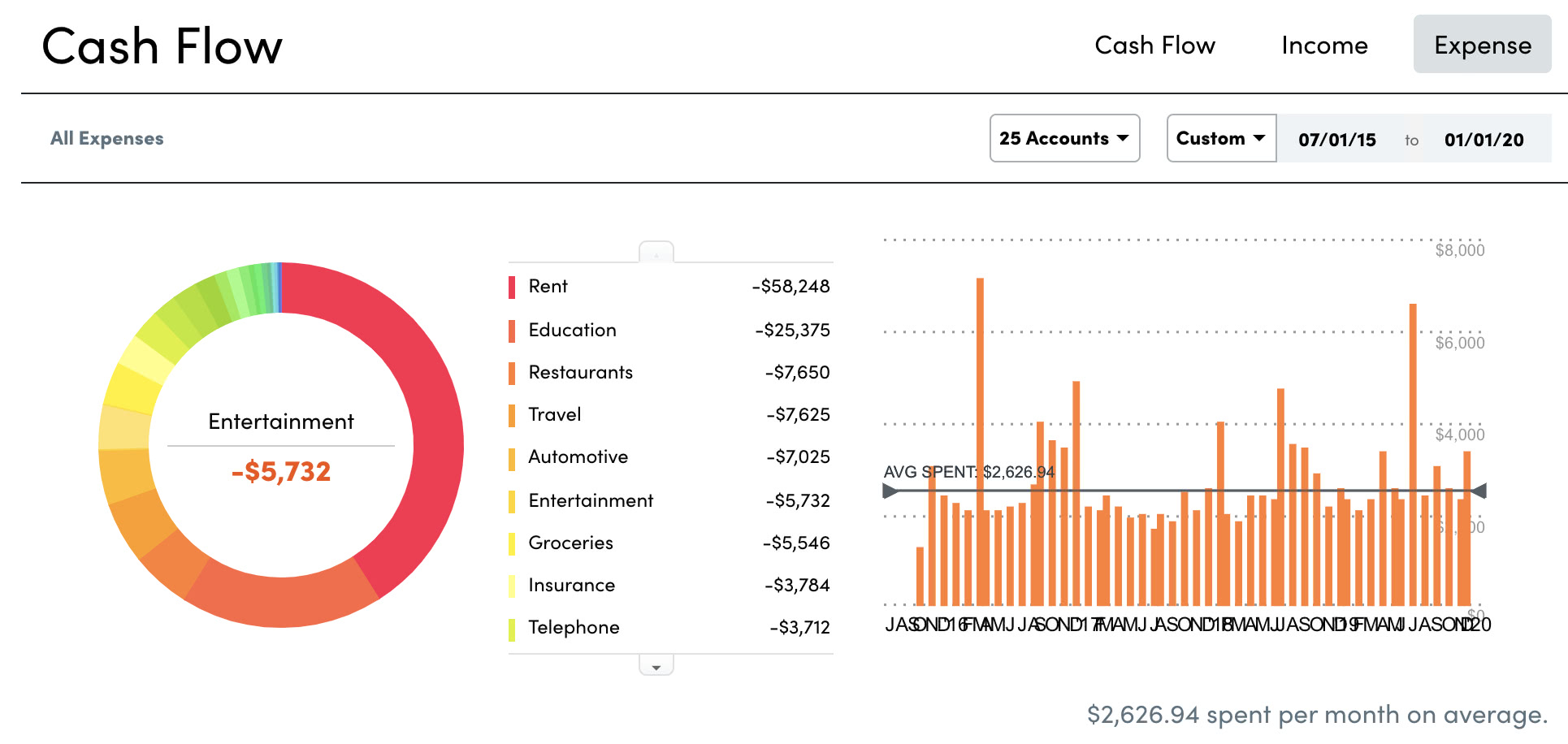

And the rest of my working years so far from Mint. Interesting to see that my spending went up as time progressed and I was earning more. #lifestylecreep.

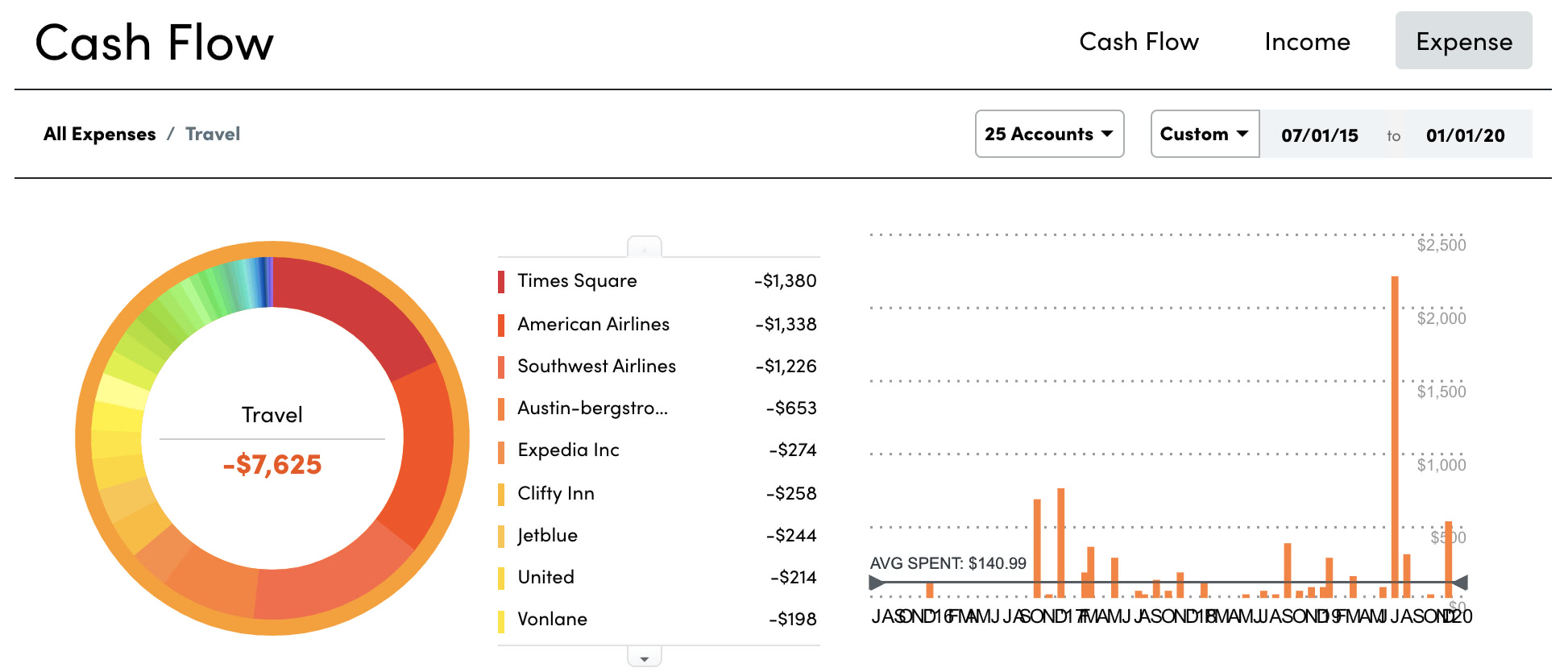

And from Personal Capital. Again, note on averages, medians would be better in this calculation, since as you see, some months have large outliers, bringing the average up. These charts also include my student loan payments under “Education.” Strange to think that I spent almost as much on all Automotive related expenses as travelling or eating out over the past 5 years.

In 2019, I did spend several thousand on a trip to New York with family, but otherwise, I found out that I really haven’t spent that much out of pocket on travel, surprisingly. Thanks credit card points!. Doing the math here, 7625 / (5 * 12) = $127 that I have spent, on average per month travelling since 2015. When you look at it that way, it does seem like a lot.

However, if you take my strict monthly budget, you’ll notice that I spent a lot in rent due to living alone in a “luxury” apartment community. If I’d found a roommate (or two) some time after graduation, I could have easily been saving myself at least $600/month.

What I’m trying to say is that not budgeting is a mistake; one that I thankfully didn’t have. I definitely could have lived off of $600/week and no one would have known differently. I explained to someone the other day that I do live paycheck to paycheck; most of my income is not liquid, and I would be penalized for accessing any of it (which I would need to if I became unemployed for a very extended period of time).

But, depending on government programs is no way to become a millionaire in nine years. That is, unless you get really lucky with some investments (trust common advice, index funds will be fine), and/or struggle though some entrepreneurial, side-hustle lifestyle, and/or get a real-estate license and bank all the commissions. Most importantly, read some personal finance books. They are on the shelves at FedEx Shipping Center, of all places (seriously)! And multiple of them, not just Dave Ramsey and his crew, for example.

Present day

Mistakes

- Stopped tracking my spending

- Buying things I don’t need

- Forgetting about subscriptions & recurring payments

- Overdrafting my checking, multiple times

- Skipping first-time homebuyer programs

- Selling my car under-value

- Getting a car payment (again)

From studies I’ve read, most of these are mistakes the majority of Americans without a budget have as well. I simply got lazy and had stopped frequently checking my spending after automating payments and transfers several years ago. For example, I ended up overdrafting my checking for the first time, ever, after using my credit card to pay the down payment on my new Accord because that money was in an external savings account.

I would say my new car payment is not justified, but I had been spending up-to $3000/yr before on maintenance with the car being roughly the same value, so I ultimately sold it off third-party (which was a surprisingly smooth process), and traded up to a 14 year newer model, which will hopefully last me the next 10-15 years.

Now that I have my first (non-smart) house, I am in desperate need to re-adjust my budget, though. When I started looking at homes, I didn’t really consider how much money I would need upfront other than a downpayment once I found the type of home that I wanted. I did, however, know how much I was willing to put down total, and even though I targeted 20% down, Austin home prices are slightly above that amount. Initially, I was looking in north Austin (Round Rock/Pflugerville) since that was where I was familiar with (and expecting the new Kalahari Resort to be amazing), but I found this area down by the airport that seems like it’ll really grow within the next few years (thanks Tesla).

I should have taken some first-time homebuyers program, though, so that I really knew what I was getting into, but more importantly Texas has various grant programs that I didn’t even bother looking at, nor were recommended by my agent (although, that might make sense if he’d made less had I done that). That site seems to suggest that it is meant for low-credit, low-income earners, however, so maybe not something I could qualify for anyway.

Ain’t they a cute couple of expensive items?

Closing Remarks

Mistakes

- Making this post too personal and rambly

- Not enough memes

In conclusion, most mistakes I’ve ran into could have been minimized by a few key principles

- If accepting a loan with interest, understand the ROI of what you’re putting that money towards. For example,

- A good education yields skills, but more importantly connections with people that can help you get placed in a good career.

- A used car is always more affordable than a brand new one, and you should definitely seek out a 3-5 year older model, which can be negotiated down to $8-10K+ off the price of newer ones.

- Austin, TX real-estate prices are not showing any signs of slowing down.

- Understand where your money is going in relation to how much is coming in (track and budget until it’s mostly automated and engrained in your habits).

- Understand that stock markets have higher returns than almost any current loan interest rate, so it’s wise to invest additional money than use towards more than minimum monthly payments.

- Play the game we call capitalism

- Credit card programs are so rewarding in order to entice you to spend more. If you just spend enough, you can reap the sign-up bonuses, and never use that card again. Their points programs also can be combined for even better returns (Chase / AMEX).

- Attend events where there is free food

- Constantly seek out better deals and negotiate with service providers on rates by threatening to cancel service.